The Pack contains associated resources for the learning experience, typically in the form of articles and videos. There is a teacher Pack (with only teacher information) and a student Pack (which contains only student information). As a teacher, you can toggle between both to see everything.

Here are the teacher pack items for New Taxes in the Colonies:

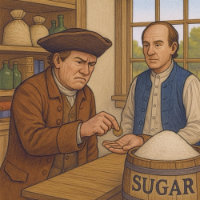

Overview In this experience, students explain how new British taxes created conflict between Parliament and the American colonists by examining perspectives, economic reasoning, and political expectations. First, students consider why people are willing or unwilling to pay taxes and reflect on the role of government funding. Then, they explore how Parliament and the colonies viewed taxation differently, especially around ideas like representation and duty. Next, students learn about the Sugar Act, the Stamp Act, and the Townshend Acts through a secondary source, identifying how each tax worked and discussing how colonists were upset with the policies. Finally, students are invited to evaluate a primary source excerpt from the Stamp Act to determine how Parliament viewed the colonies’ financial role in the British system. Estimated Duration: 45–60 minutes Vocabulary Words and Definitions Objectives:

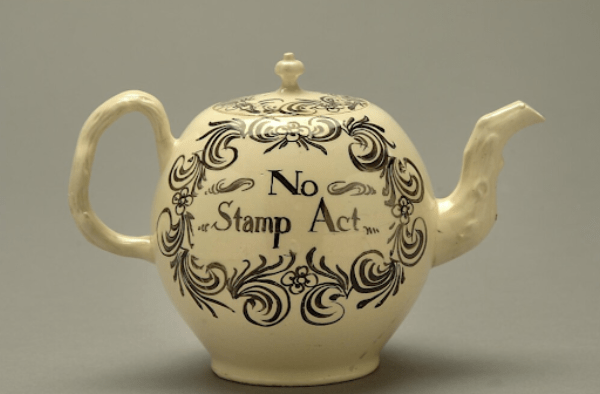

A teapot opposing British taxes (1766 - 1770)

Governments need money to operate, make decisions, and carry out their plans. One way they collect this money is through taxes. Taxes are payments people are required to make to the government, usually based on what they buy or the money they earn.

In the class table below, brainstorm reasons why people might be willing to pay taxes to the government and why people might not want to pay taxes. Think about services, responsibilities, or situations where people may or may not be willing to contribute. Add your ideas to the class list. Try not to repeat any answers from your classmates on the table.Add your ideas to the class list. Try not to repeat any answers from your classmates on the table.

After students add their ideas to the table, guide a short discussion to reflect on the variety of ideas shared. Avoid introducing specific British tax laws at this point. The goal is to help students consider general reasons people may or may not support paying taxes to a government. This conversation lays essential groundwork for the rest of the experience, where students will examine how the colonies responded to Britain’s new tax policies after the French and Indian War.

In this lesson, you will learn about the new taxes Britain imposed on the colonies after the French and Indian War and how colonists started to respond. You will begin exploring how these taxes created tension between the colonies and the British government.

Objectives: