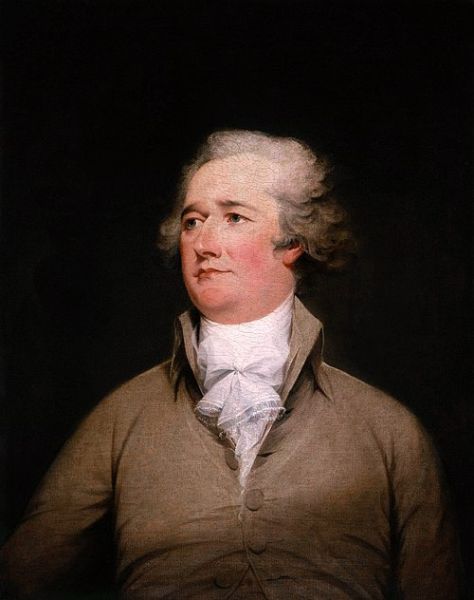

The United States created two early national banks to help organize its economy. The First Bank of the United States was established in 1791 after the American Revolution. The young country had war debts, and Alexander Hamilton, the Secretary of the Treasury, wanted a place to safely keep government money, collect taxes, and issue loans. The bank also created paper money that could be used across all the states, which made trade and business easier. Many leaders, including President George Washington, supported the bank, but others worried it gave too much power to the federal government. The First Bank’s charter lasted for 20 years, and it closed in 1811 when Congress chose not to renew it.

The Second Bank of the United States was created in 1816, after the War of 1812. The war had left the nation in debt again, and the government needed a strong bank to help stabilize the economy. Like the first bank, it stored government funds, loaned money, and issued national currency. It also worked to control the activities of smaller state banks, which often printed too much money. Some people, especially farmers and local bankers, disliked the Second Bank, saying it favored wealthy businessmen. President Andrew Jackson strongly opposed it and worked to shut it down in the 1830s.

Both banks played important roles in the early economy by helping the government manage money, but they also caused debates about how much power the federal government should have.